Analysis of Gen Z’s Response to the Fomo-Inducing Ads of Flipkart on Instagram

Abstract :This study unveils the intricate and multifaceted interaction of Indian Gen Z consumers with the FOMO-inducing ads of Flipkart on Instagram. It analyses the cognitive and emotional responses of Gen Z. Dissecting the influential power of FOMO, it sheds light on the positive interlink and interconnectivity of FOMO with impulsive purchase. Diving into the subconscious, this study identifies the FOMO-appeal which is the most attractive to Gen Z, propelling spontaneous purchase.The study abridges the gap in the field of existing research on FOMO. Initially, the discipline of psychology elaborated on FOMO. Later on, it expanded into the marketing field, with the growing recognition of FOMO as an essential trigger in advertising among the researchers. Nonetheless, there’s a gap in the specific type of FOMO appeal, to which the Gen Z consumers interact the most. For the first time, social media ads of an Indian e-commerce giant, i.e., Flipkart, are being analysed, through the lens of FOMO, from the eyes of Gen Z. This is a quantitative study, utilising ‘questionnaire survey’ as the method to gather the valuable perceptions and the resultant emotions of Gen Z towards FOMO-inducing ads, to draw a notable conclusion that FOMO is a positive motivator for Gen Z’s consumption behaviour.

Keywords: FOMO, Gen Z, Impulsive Consumption, Social Media ads, Consumer Behaviour

Introduction

The Digital Revolution and Gen Z’s FOMO-Driven Consumption

Human ambition and innovation have sparked a digital revolution, creating a boundless virtual realm. Since the emergence of Web 1.0 in the late 1980s with Tim Berners-Lee’s World Wide Web, technological advancements have surged at an unstoppable pace. Mobile communication became seamless, blurring the lines between the physical and digital worlds. The rise of social media further fused these realms, creating a hyper-connected society where the world is accessible with a single tap.

Amid this digital evolution, Generation Z (born between the late 1990s and early 2010s) emerged as the first true digital natives. Their deep bond with social media shapes how they interact with the world. Social media serves as both an escape and an aspiration, curating a world of perfection that contrasts with reality. Platforms like Instagram seduce Gen Z with vibrant visuals and the lure of social validation, fueling hours of mindless scrolling. This cycle of addiction is driven by the promise of connection and inclusion — and the fear of missing out (FOMO) if they don’t engage.

FOMO creates a constant undercurrent of anxiety for Gen Z. The fear of missing out on events, trends, or deals fuels compulsive social media use. Missing a concert or not buying the latest trending product triggers regret and insecurity. The urgency to stay relevant and connected makes Gen Z vulnerable to FOMO’s emotional pull. Even experiences not shared online feel incomplete. Social media platforms capitalize on this vulnerability, creating a cycle where Gen Z seeks validation through likes and engagement to avoid feeling left out.

Social media’s omnipresence has reshaped consumer behavior, making Gen Z key players in the digital economy. Advertisers have harnessed this shift, using FOMO to drive purchasing decisions. Instagram, with its highly visual and youth-focused format, has become a prime platform for targeting Gen Z. Flipkart, India’s leading e-commerce giant, has mastered this strategy. Its main Instagram page boasts 4.2 million followers, with strong engagement on secondary pages like Flipkart Lifestyle (260K), Flipkart Video (248K), and Flipkart Stories (33.6K).

Flipkart expertly taps into Gen Z’s FOMO through strategic advertising during big sale events like the Big Billion Days and the Big Year End Sale. By creating a sense of urgency and scarcity—“limited offer,” “running out soon,” “timer countdown”—Flipkart manipulates the emotional triggers of FOMO. The fear of missing a deal drives impulsive buying, reinforcing the connection between emotional anxiety and consumption. These ads go beyond product promotion; they build an emotional bond with Gen Z, aligning with their aspirations and insecurities.

FOMO’s influence extends beyond immediate purchases. It creates a loop of anticipation, gratification, and repeated behavior. The emotional rush of securing a deal fades into regret and renewed desire, sustaining the cycle of consumption. FOMO was once seen as a psychological trait, but advertisers have weaponized it to shape consumer behavior. The fusion of FOMO and social media advertising blurs the line between genuine needs and artificially induced cravings.

This study explores the psychological underpinnings of FOMO and its impact on Gen Z’s buying habits. It highlights how Flipkart’s targeted FOMO-driven ads effectively exploit Gen Z’s emotional triggers, leading to impulsive consumption. The findings confirm a strong link between FOMO-based advertising and consumer behavior, offering insights into the strategic use of FOMO to influence Gen Z’s purchasing decisions.

Objectives of the Study

- Understand how Gen Z perceives FOMO advertising.

- Investigate how FOMO advertising impacts the buying habits of Gen Z.

- Identify the kind of FOMO appeals used in e-commerce advertising which entices Gen Z the most.

Review of Literature

Decoding Gen Z’s Consumer Behavior: The Intersection of Social Media, E-Commerce, and FOMO

Understanding Generation Z’s consumer behavior requires a deep dive into the intersection of social media, e-commerce, and the pervasive influence of FOMO (Fear of Missing Out). This study examines how Gen Z’s digital lifestyle shapes their purchasing habits and how advertisers leverage FOMO through targeted ads to influence their decisions, particularly on platforms like Instagram.

Gen Z’s Digital DNA

Generation Z, born between the late 1990s and early 2010s, is the first generation of true digital natives (Kahawandala& Peter, 2020). Unlike previous generations, Gen Z grew up immersed in the internet, smartphones, and social media, making digital technology an intrinsic part of their identity. Also referred to as the “gadget generation” (Herawati, Rizal &Amita, 2022), they have never known a world without instant access to information and communication. Their digital fluency enables them to navigate online environments with confidence and ease (Rothman, 2016).

Gen Z’s relationship with technology goes beyond familiarity—it is symbiotic. Smartphones are not just tools but extensions of themselves, facilitating communication, entertainment, shopping, and social connection. Studies have shown that Gen Z spends an average of over eight hours daily on their smartphones, managing multiple social media accounts simultaneously (Rizal, 2020). This generation’s reliance on technology has shaped not only their social interactions but also their approach to consumerism and brand engagement.

Gen Z is highly vocal and socially conscious, using social media platforms to express opinions and engage with global issues (Sladek&Grabinger, 2014). They seek authenticity and value peer recommendations, which significantly influence their purchasing decisions (Jain et al., 2014). Their sense of belonging is tied to their online presence, where trends, pop culture, and social validation converge to shape their identity. Staying updated and relevant within their peer group is a core social driver for Gen Z’s behavior, including their consumer habits.

Social Media: The Centerpiece of Gen Z’s Social Life

Social media has evolved from a recreational activity into a central pillar of Gen Z’s daily life. Platforms like Instagram, TikTok, and Snapchat are not just for connecting with friends but also for discovering products, engaging with brands, and shaping identity. Over 88% of 18- to 29-year-olds are active on social media, and Gen Z dedicates over three hours daily to scrolling through content, surpassing older age groups (Ilakkuvan et al., 2019; Hruska&Maresova, 2020).

Gen Z’s preference for short-form, visually engaging content has shifted their focus away from traditional platforms like Facebook toward Instagram and TikTok (Wilmer &Chein, 2016). Their low attention span—averaging just eight seconds (Hubspot, 2019)—has driven the success of quick, visually appealing content that delivers instant gratification. Privacy concerns have also influenced platform choice, with Gen Z gravitating toward platforms that offer more control over content sharing and audience targeting (Boyd, 2015).

The rise of influencer culture has further blurred the line between social interaction and consumer behavior. Gen Z prefers learning about products and services from influencers rather than traditional advertisements (Hubspot, 2019). A significant portion of Gen Z also uses ad blockers, forcing brands to adapt by embedding advertising within social media content through influencer partnerships and organic-looking posts. This strategic shift has made social media a discovery platform for brands rather than just a marketing tool.

E-Commerce and the Digital Consumer Mindset

E-commerce has become second nature to Gen Z. Unlike previous generations, who transitioned from physical stores to online shopping, Gen Z grew up in an era where online shopping was already the norm. The convenience, variety, and competitive pricing of online retail have made e-commerce the preferred shopping method for this cohort (Chen et al., 2017; Thaichon, 2017).

Gen Z values seamless digital experiences, from product discovery to checkout. They are price-conscious and seek the best value for money, but they are also influenced by user reviews, product presentation, and social proof (Accenture, 2017). With the rise of online payment systems and e-wallets, purchasing is quick and convenient. The abundance of choices, however, can lead to decision fatigue and “information overload” (Gao& Simonson, 2016). To combat this, Gen Z relies on filtering tools and curated product recommendations to simplify the shopping experience.

The shift toward digital consumption has prompted brands to refine their online presence. Platforms like Flipkart have capitalized on this trend, building robust social media communities to engage Gen Z. Flipkart’s strategic use of Instagram, with dedicated pages for lifestyle, video content, and storytelling, reflects the brand’s understanding of Gen Z’s media consumption patterns.

FOMO: The Psychological Driver of Gen Z’s Consumer Behavior

Fear of Missing Out (FOMO) has emerged as a defining psychological trait of Gen Z. Initially identified as a social anxiety phenomenon, FOMO has been weaponized by marketers to drive consumer behavior (Przybylski et al., 2013). FOMO is rooted in the psychological need for social belonging, competence, and autonomy (Deci& Ryan, 2015). When these needs are unmet, individuals experience anxiety and a fear of exclusion, which drives them to engage more actively with social media and consumer culture.

Marketers have recognized the power of FOMO and integrated it into advertising strategies. Limited-time offers, countdown timers, and “only a few left” messages tap into Gen Z’s fear of missing out on valuable experiences or products. Flipkart’s major sale events, such as Big Billion Days and Year-End Sales, are prime examples of FOMO-driven campaigns. The urgency created by limited-time deals compels Gen Z to make quick purchasing decisions to avoid the regret of missing out.

Social media platforms enhance the effectiveness of FOMO-based advertising by creating a sense of social comparison. Seeing peers post about exclusive experiences or new products triggers envy and increases the perceived value of the advertised item (Good & Hyman, 2020). The emotional anticipation of acquiring a product creates a dopamine-driven cycle, reinforcing impulsive buying behavior. Rationalization—convincing oneself that the purchase was necessary or beneficial—further justifies and solidifies the behavior (Good & Hyman, 2020).

The Commercialization of FOMO

Dan Herman was one of the first marketers to explore FOMO as a strategic tool in consumer behavior (Çınar, 2021). He identified three key components of FOMO-driven consumption:

- Recognizing appealing options – Consumers become aware of multiple attractive choices.

- Believing they can access these options – The perception that they have the ability to seize the opportunity.

- Fear of being left out – The anxiety that others might benefit while they miss out.

Scarcity and urgency are the two primary tactics used in FOMO-driven advertising (Jang et al., 2015). Scarcity-based ads create a perception of limited availability, increasing the desirability of a product. Urgency-based ads impose time constraints, forcing quick decision-making. Flipkart’s countdown timers and “last chance” messages are classic examples of FOMO-based urgency tactics.

Impulse buying, a core characteristic of FOMO-driven behavior, reflects the emotional response triggered by these strategies. The anticipation of satisfaction, combined with the fear of regret, motivates Gen Z to make spontaneous purchases. This pattern reinforces a cycle where FOMO becomes a consistent driver of consumer decisions.

Research Methodology

Quantitative research is employed to gain insights into ‘The Analysis of Gen Z’s response to FOMO-inducing ads of Flipkart on Instagram.’ It reveals insights which contribute to the comprehension of the mechanism of the FOMO triggers. Through the quantitative research approach, the vastly complex behaviour of Gen Z is quantified to simplify and understand the overarching patterns of their consumption psychology and behaviour in the context of FOMO triggers. The universe of the study is Gen Z, born in the late 1990s to early 2010s in metro cities. For the study, the population is zeroed in on the 18-25 years, living in the top tier 1 metro cities of India- New Delhi, Mumbai and Bangalore. The sample group of 18-25 is chosen due to their prominent presence on Instagram. They are the young adults who have set out for their academic and career journeys in big tier-1 cities. Considering this delicate dichotomy- the virtual yearning for social connectivity along with the solitary navigation in big cities; they are susceptible to the FOMO triggers.

Primary research has been conducted for the same. It involves collecting original data directly from the source, rather than relying on pre-existing data samples. It is conducted to address a certain problem that requires in-depth analysis. The duration of the study was 3 months. A survey was conducted. The survey was floated and open for ten days- from 18th December 2023 to 27th December 2023. The sample size is 202. The segment of 18-25 is well represented with 79.7% in the perception survey’s responses. The sampling method used is the non-probability sampling method, where individuals are selected on certain criteria. The sampling techniques used were purposive sampling (also known as judgment sampling) and snowball sampling. Two sampling techniques assisted in reaching a wider population for the study. Purposive sampling enables the selection based on possession of certain characteristics to align with the purpose of the research study and steer it on the right course utilising the ‘judgment’ of the researcher in the sample collection. The collective characteristics of Gen Z who reside in big cities for academic studies or jobs are consistent in the respondents. The snowballing technique has assisted in reaching a wider population through a ‘chain’. The respondents have further circulated the survey among their connections.

Data Analysis

The method used for data collection was an online questionnaire survey. The form was open for ten days- from 18th December 2023 to 27th December 2023 and over time accumulated 202 responses. The insights of the respondents were fruitful to the study and successfully aligned the findings with the research objectives.

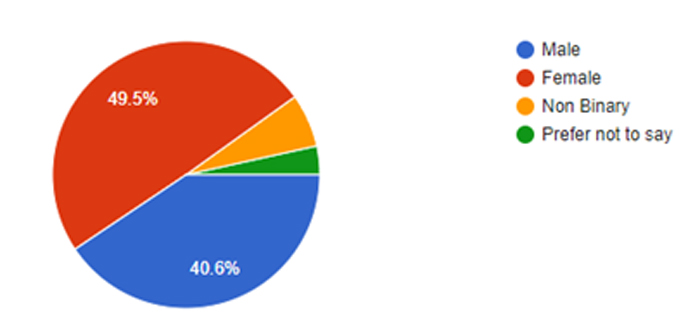

Nearly half (49.5%) of the respondents identified as female (100 respondents), while 40.6% identified as male (82 respondents). A smaller percentage (6.4%) identified as non-binary (13 respondents), and 3.5% preferred not to disclose their gender (7 respondents).

The survey included responses from individuals across the gender spectrum, providing a more inclusive and equitable understanding of Gen Z’s perception of FOMO advertising. Both male and female perspectives are well-represented in the survey, with close to almost equal proportions of respondents in either category.

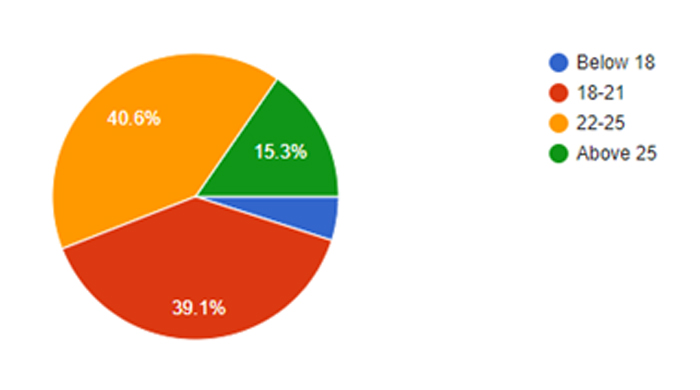

40.6% of the respondents were 22-25 years old (82 respondents), 39.1 % of the respondents were 18-21 years old (79 respondents), 15.3 % were above 25 years old (31 respondents) and lastly 5% were below 18 years old (10 respondents).

As the research strives to analyse the consumer behaviour of ages 18-25 and their interaction with FOMO-driven ads, the target audience is well represented. 79.7% of respondents (161 out of 202 respondents) fall within the study’s desired age range of 18-25 years old. It also acknowledges the presence of age groups outside the study’s target audience (below 18 and above 25). With the majority of the respondents falling within the 18-25 age range, their perspectives likely dominate the data and will be the primary focus of the study’s analysis. The smaller groups’ responses may not add significant noise or bias to the findings.

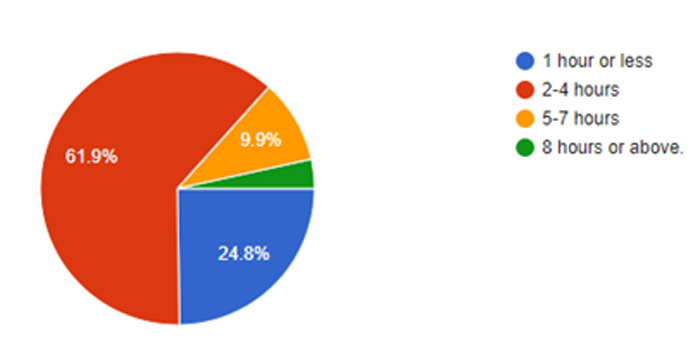

A significant 61.9% of respondents (125 respondents) reported spending 2-4 hours daily on Instagram, indicating it’s the dominant usage category. 24.8% (50 respondents) spend 1 hour or less on Instagram, suggesting a sizable group with lighter engagement. 9.9% (20 respondents) spend 5-7 hours and 3.5% (7 respondents) spend 8 hours or more, highlighting only a minority with potentially high engagement on Instagram. This question’s finding is consistent with prior research done in this field, suggesting that young adults typically spend 2-4 hours on social media platforms like Instagram. The demography of 18-25 embarked on their career journey- be it office or university- which requires a significant commuting time. It can be interpreted that this time is invested in social media. It denotes that screen time on Instagram is a significant part of daily routine activity.

A vast majority of respondents (93.1%) experience the urge to check Instagram even without internet access, in some form or the other, highlighting its significant hold on Gen Z’s attention. Only 6.9% of the respondents, a minuscule fragment in the sample, can resist the pull of social media (14 respondents out of 202).

The data reveals the gradual growth of ‘the social media habit’ among Gen Z.’ with 40.6 % (82 respondents) claiming that social media has embedded itself in their daily routine. And 31.2 % (63 respondents) experience restlessness, suggesting susceptibility to FOMO and a strong perceived need to always stay connected. 21.3% (43 respondents) only feel the urge occasionally upon the anticipation of specific content or information, demonstrating a more controlled relationship with Instagram.

The persistent need to stay connected, a habit fostered by frequent online engagement, can create a subconscious dependency on checking social media platforms, even without internet access. The mind has been classically conditioned to satiate the ‘habit loops’. The need to stay up to date fosters the habit of frequently checking social media. It creates a habit loop, so much so, that even the mere presence of a phone triggers an automatic urge to check Instagram, regardless of proper internet access. Further dopamine anticipation adds to it, there’s a possible anticipation of rewarding social interaction by hopping onto the bandwagon. It further strengthens the habit of social media checking, with FOMO sustaining the vicious cycle of doom-scrolling.

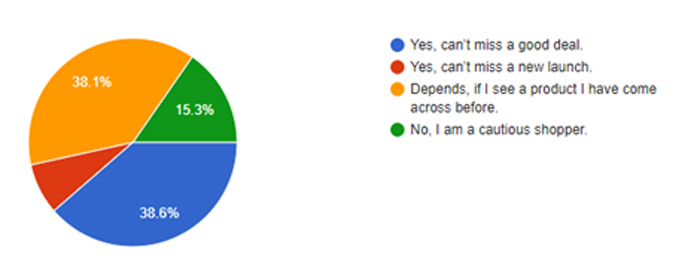

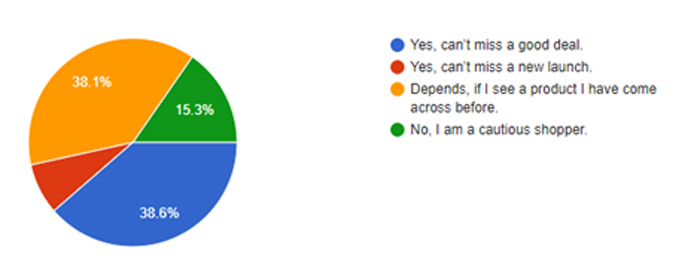

Only 15.3% (31 respondents) resisting the temptation of giving into the frenzy of shopping, are cautious and vigilant shoppers. An ad disseminating a new launch may not excite as much, for only a meager 7.9 agree to buy new launches, for it only has the limited appeal of novelty alone. The remaining 84.6 % of the respondents’ purchase decisions are affected by the ads on Instagram, in some way or the other.

There’s an equal tie between the two groups in terms of response, unfolding a nuanced understanding of purchase decisions. There are almost equal numbers of respondents who reported that they cannot afford to let go of a good deal (78 respondents) and the other half whose interaction with the ad depends on their familiarity and previous engagement with the product in the ad (77 respondents). The group which is inclined towards ‘good deal,’ reflects their innate FOMO (fear of missing out) and social validation, suggesting that ads tap into the desire to stay trendy and avoid missing out on popular products. It also denotes the need to acquire budget-friendly deals, indicating the price consciousness trait of this cohort which can lead to impulse buying. The second group resonates with personalised and familiar ads better. It signifies that the higher frequency of ads is directly proportional to a higher call to action, building better recall value. And retargeting ads with FOMO is more impactful, since missing out on an interesting product may elicit more emotional anxiety for the buyer. Both groups are susceptible to influence, based on external factors, but in different ways. One is driven by immediate deals and the other by familiarity.

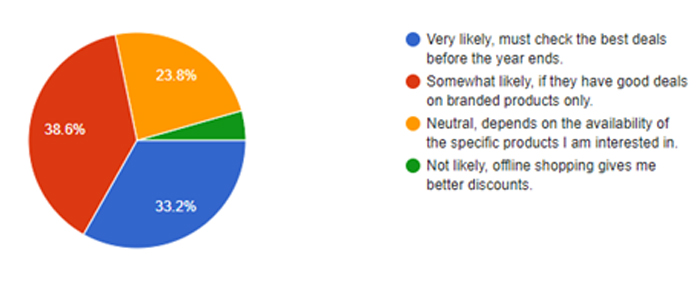

33.2 % of the respondents are enthusiastic and highly likely to check the sale before the year ends, without any proper conditions, unlike the rest. The tagline of the ad ‘SaalkaAkhriDhamaka’ effectively utilizes urgency and FOMO, emphasizing the limited-time nature of the sale and encouraging immediate action. It also implies the preference of 67 respondents towards the limited-time appeal of FOMO.

The brand partnership with Puma on the ad imparts perceived value and quality, drawing brand-conscious consumers. 38.6% of the respondents, the majority out of the lot, respond to the condition of deals on branded products. The inputs of 78 respondents, furthermore reiterates the price consciousness of this demography. Branded products otherwise are premium, only during sales they are available at pocket-friendly rates. 23.8% remain neutral, prioritizing specific products, and indicating the need for personalized marketing. 48 respondents are unlikely to be impulsive buyers and prefer more personalized ads over generic ones. Only 4.5% (9 respondents) favour offline options, suggesting that online sales resonate with the majority.

A major chunk of 67.9 % of respondents experience negative emotions of regret and envy from missing the sale, accentuating the influence of FOMO and giving into its pull, to evade negative emotions. The most prominent emotion processed by 43.1 % of respondents, is regret upon missing the opportunity. 87 respondents additionally reinforce the value-consciousness trait, where they equate the missed sale with the missed possibility of saving through discounted deals. They are motivated by the idea of saving through budget-friendly shopping.

24.8% feel left out when they see others sharing their successful shopping experiences on social media, indicating the power of peer pressure in driving emotional responses. The influence of social media pressure and “hauls” reinforces the desire to participate in the sale and avoid feeling left out, impacting emotional responses, and even negative responses like envy. 50 respondents feel excluded and left out, while their immediate social connections snagged better deals, resulting in the amplification of FOMO. Witnessing others’ hauls triggers social comparisons, igniting envy and a burning desire to emulate their actions. The perceived social validation gained from owning trendy items takes centre stage, creating intense pressure to join the consumer frenzy. It also indicates how peer influence manoeuvres impulsivity for this cohort.

21.3% remain unaffected and do not exhibit any strong emotional response upon missing the social events. It demonstrates that 43 respondents are mindful of their consumption patterns. They prioritise needs over wants and avoid impulse buying or hopping onto trends, leading them to feel content and satisfied with existing possessions. They concentrate on quality and lasting value and are comparatively less excited over a sale. FOMO-driven approaches do not persuade them. 10.9% expressed resourcefulness and optimism amid the missed opportunity of a sale. Resilience is reflected in their shopping strategy. However, only 22 out of 202 respondents are willing to adopt a proactive approach to seek alternatives in the face of a missed opportunity.

It can be deduced that succumbing to FOMO and missing out on major sales like Flipkart’s “Big Billion Days” often elicits negative emotions like regret, envy, and inadequacy, affecting over two-thirds of respondents in the study.

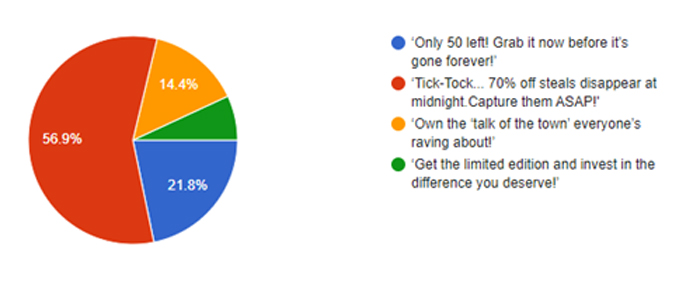

21.8% were drawn to the ad communicating the scarcity of the product. With scarcity, the perceived value and quality increases, especially if it’s exclusive. The scarcity of a product becomes a core motivator of purchase. ‘50 left’ infuses a tangible perception of scarcity, prompting buyers to take immediate action. The scarcity of product creates an urgency, and inevitably FOMO sprouts, if one fails to seize it. 14.4% related to the “talk of the town” copy, suggesting the influence of social trends and peer validation and belongingness in driving purchase decisions. The popular product or service percolates into the subconscious, molding the desire to own it. FOMO eliciting from the popular product incentivizes buyers to purchase the product to evade feeling left behind or socially excluded from the trend. Lastly, only a meager 6.9% of respondents resonated with limited edition with a premium approach, indicating not everyone is motivated by sole exclusivity.

More than half of the respondents, 56.9% gravitated towards the discount-oriented appeal, coupled with limited time. 115 respondents’ preference for price sensitivity further substantiates price consciousness as one of the important traits in Gen Z’s consumer behaviour. 70% discount in the copy, portrays significant financial benefit and value proposition. The limited-time offer further incentivizes and prompts immediate action to seize the amazing discounted product. With the dominance of budget-consciousness in the responses, it can be deduced that value-based FOMO appeal in ads is most likely to stimulate Gen Z.

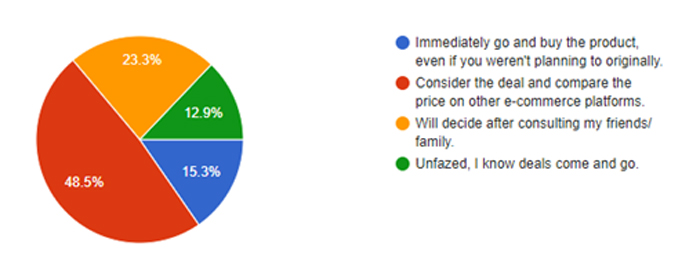

The second largest group, 23.3% relies on social networks, highlighting the trust in peer recommendations for purchase decisions. Here, for the 47 respondents, their social connections can stir FOMO. Family and friends are conduits for social trends and significantly influence purchase decisions. If they are enthusiastic and optimistic about the deal, it enhances FOMO, prompting purchase. Additionally, discussing the offer with their peers or family can assist in mitigating perceived risks linked with the purchase. Shared decision-making can alleviate potential regrets and increase confidence in the choice. Peer recommendations are useful to assess the value and legitimacy of the deal. The social network is an important source of information and validation for the second-largest group of respondents.

A smaller group succumbs to the limited time and scarcity appeal, triggering unplanned purchases for 15.3%. 31 respondents are impulsive, indicating immediate susceptibility to FOMO. However, time urgency and stock scarcity might not be the best motivators for purchase, inferring the presence of other factors for a spontaneous purchase decision. Lastly, only 12.9 % remain neutral and unaffected by the ad, denoting experienced consumers who are aware of the cyclical nature of promotional offers. The urgency of the offer did not affect 26 respondents. But it also infers that the rest 87.1% are not immune to the influence of the ad, and are impacted by it, in some way or the other.

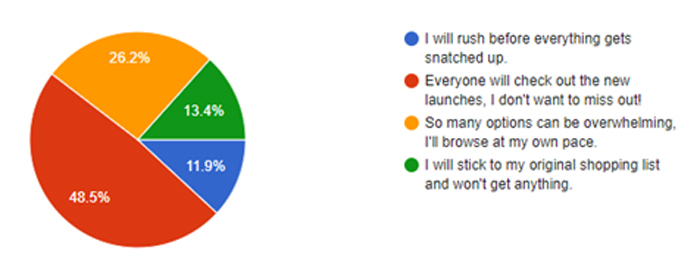

48.5% or the majority of the respondents prioritize getting the best deal and maximizing their purchasing power. Even with a seemingly attractive offer (“exclusive,” “countdown timer”), they want to ensure they’re getting the lowest price available before committing. With product scarcity and time urgency, the value proposition is not clear, comparing the prices helps to clarify the actual benefit and determine whether it’s worth taking advantage of. The data here again reiterates the dominance of price consciousness in the FOMO appeal most engaged with.

11.9% are susceptible to extreme FOMO. They have competitive anxiety, as they may perceive an abundance of choices as a competitive landscape, where others are eying for the same deals, urging them to rush and seize the best deals. But only as low as 24 respondents feel the time urgency, as neither does the ad have a deadline for the sale nor does it hint towards limited product availability.

13.4 % adhere to their predetermined shopping plan. They are strategic and organised shoppers who have a clear understanding of their ‘needs’ and do not get swayed by the illusionary needs promised by the ad. However, only 27 do not get affected by the enticing offers, which reinforces the influence of alluring ads on purchase decisions.

26.2 % display a measured approach. They have a preference for a controlled shopping experience. Faced with an abundance of options, they tread cautiously. They prioritize mindful exploration over the fear of missing out or spontaneous, impulsive decisions. With a plethora of options, time and effort are required to compare features, prices, and brand reputation before making a decision.

48.5% of the respondents feel the need to join the crowd, and not get left behind. Witnessing others get excited about the wide variety of deals, can create a sense of social pressure and influence their behaviour. The “herd mentality” can drive them to join the crowd and check out the new products, even if their initial interest wasn’t high. It also implies that choices excite buyers and act as a motivator to engage with the ad. With almost half of the respondents experiencing the need to check the sale, shows the power of social influence on FOMO.

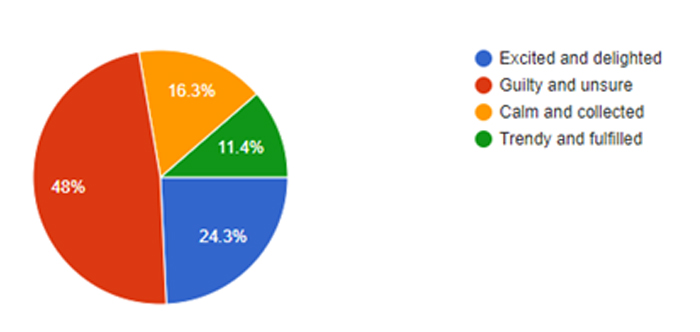

The second largest segment, 24.3 % experience thrill and joy upon the spontaneous purchase. Upon seizing the opportunity of the deal, they experience excitement. It also suggests that, given how excitement is the second most experienced emotion, ‘excitement’ is the immediate emotion after an impulsive purchase, but gradually through meticulous consideration, it becomes regretful.

16.3% remain cool and calm as they are comfortable with spontaneous purchases. It implies they might possess strong financial planning; inferring thorough deliberation before purchase.11.4% prioritizes keeping up with trends and fulfilling needs for self-expression and social belonging. The purchase likely aligns with their desired persona and brings them a sense of accomplishment and trendiness, overshadowing any potential guilt.

While FOMO drives initial excitement and prompts spontaneous purchase, it slowly morphs into feelings of regret and doubt post-purchase. 48% are remorseful and feel guilty after a hasty purchase. It is the dominant emotion among a majority of respondents, 97 out of 203. It indicates that buyer’s remorse is stronger after an impulsive purchase. The findings indicate the complex roller-coaster emotions the buyer experiences after a spontaneous purchase.

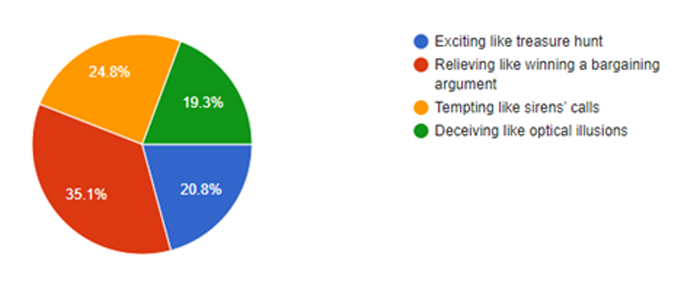

20.8% consider them exciting, similar to uncovering hidden treasures. They enjoy the thrill of finding bargains, exploring hidden gems, and potentially securing items at significantly lower prices. 19.3 % express scepticism towards online deals, assessing them as potentially misleading. They worry about hidden conditions, false discounts, or misleading claims, similar to how optical illusions can trick the eye. This cautiousness stems from past negative experiences or general distrust towards marketing tactics.

24.8% of respondents view these online deals as tempting, akin to the allure of sirens’ calls. This suggests that these deals have a strong appeal and enticement, drawing individuals in through their attractiveness or temptation. But they are aware of the pitfalls of online deals and even though they are attractive, they can resist the charm.

And lastly, the largest segment, 35.1 % of respondents perceives these deals as relieving, similar to winning a bargaining argument. This implies that a significant portion feels a strong sense of relief or accomplishment when they secure discounted deals through social media or peer recommendations, emphasizing satisfaction, like a successful negotiation. This finding again underlines and amplifies the price-sensitive appeal being the most fascinating appeal to Gen Z. Gen Z is the most responsive to budget-driven communication style.

Conclusion

Insights on FOMO-Driven Ads and Gen Z’s Buying Behavior

The study reveals key insights into the impact of FOMO (Fear of Missing Out) on purchase decisions, especially among Gen Z. FOMO triggers insecurities with enticing appeals, shaping buying behavior by creating a sense of urgency and exclusivity. Social media amplifies this effect, as Gen Z’s compulsive engagement with platforms like Instagram (spending 2-4 hours daily) fuels a cycle of doom-scrolling and impulse buying. When integrated into social media ads, FOMO strengthens the emotional pull, driving purchase decisions.

Gen Z’s reaction to FOMO ads is complex, blending excitement with doubt. FOMO creates cognitive dissonance — the thrill of a potential deal clashes with the fear of regret if missed. To reduce this tension, buyers either make the purchase to avoid regret or rationalize not buying. However, Gen Z’s price sensitivity often overrides hesitation when the ad’s message emphasizes affordability. The certainty of purchase increases with ad familiarity, as social media’s retargeting strategies reinforce brand recall and the FOMO effect.

FOMO ads drive both impulse and calculated purchases. The fear of missing out on a limited-time deal, coupled with the pressure to keep up with peers, encourages quick decisions. Social media’s personalization strategies further strengthen this effect through retargeting, increasing conversion rates. The variety of choices in ads can cause decision paralysis, yet the fear of not finding the “perfect” option heightens FOMO. Flipkart effectively leverages this by highlighting variety in its ads, boosting engagement.

Price consciousness is a key factor for Gen Z, particularly the 18–25 age group. As young adults navigating new cities for jobs or studies, they seek value-based FOMO deals. Scarcity, exclusivity, and social belonging appeal to their desire for both affordability and self-image enhancement. Gen Z’s aspirational mindset drives them to seek branded products at discounted rates, fueling anticipation for sales festivals. FOMO-induced stress to stay relevant while maintaining a budget pushes them toward impulse buys, followed by feelings of relief upon securing a deal. Missing such opportunities often results in regret, reinforcing the cycle of FOMO-driven consumption.

Emotional responses post-purchase are layered. Initial excitement and relief from securing a good deal can give way to doubt and guilt as the thrill fades. FOMO ads blur the line between “want” and “need,” encouraging unplanned consumption. Value-based FOMO appeals, especially with time urgency, drive immediate action. Advertisers can capitalize on this by using scarcity, exclusivity, and social proof to enhance FOMO’s pull. Gen Z’s deep social need to “fit in” makes them especially receptive to these strategies.

Limitations of the Study

- Sample Bias – The study’s findings are based on 18–25-year-olds, which may not fully represent the broader Gen Z population with varying cultural, economic, and social backgrounds.

- Limited Scope of FOMO – The study focused on FOMO as a key driver but didn’t explore other ad elements like brand ambassadors’ influence or celebrity endorsements.

- Quantitative Rigidity – The survey’s structured format left little room for subjective insights that qualitative methods like interviews or focus groups could provide.

- Ad Variability – Only two Flipkart ads were used, limiting the scope and potentially generalizing the findings.

- Self-Reported Bias – Since respondents completed the survey themselves, responses may be influenced by social desirability or inaccuracy.

FOMO-driven ads significantly influence Gen Z’s buying decisions, balancing emotional excitement with price sensitivity. Value-based FOMO appeals that highlight affordability and exclusivity are particularly effective, reinforcing the emotional cycle of anticipation, satisfaction, and regret.

References :

- Hartini, S., Mardhiyah, D., &Alfina. (2023). FOMO-related consumer behaviour in a marketing context: a systematic literature review. Cogent Business & Management.

- Megan C., & Good, M. R. (2020). ‘Fear of missing out’: Antecedents and influence on purchase likelihood. The Journal of Marketing Theory and Practice.

- Bautista, R., &Saavedra, R. (2020). Are you “in” or are you “out”?: Impact of FoMO (Fear of Missing Out) on Generation Z’s Masstige- brand Apparel Consumption. Asia-Pacific Social Science Review.

- Kahawandala, N., & Peter, S. (2020). Factors affecting Purchasing Behaviour of Generation Z. Proceedings of the International Conference on Industrial Engineering and Operations Management.

- Özhasar, Y., &Kilic, O. (2021). Examining the effect of FOMO on conspicuous consumption and assimilation: a study on Gen Z.Journal of Gastronomy Hospitality and Travel (joghat).

- Kushwaha, B.(2021). Paradigm shift in traditional lifestyle to digital lifestyle in Gen Z: A conception of consumer behaviour in the virtual business world. International Journal of Web Based Communities.

- Wansi, J., (2020) How do Instagram influencers affect the consumer buying behaviour of Gen-Z? Artevelde University of Applied Sciences.

- Gaurav, K., & Ray, A.(2020). Impact of Social Media Advertising on Consumer Buying Behavior in Indian E-commerce Industry. Sumedha Journal of Management.

- Özden, A. (2022) “Not Ignoring the FoMO (Fear of Missing Out) Effect” as a New Way to Persuade Consumers to Buy. Narrative Theory and Therapy in the Post-Truth Era.

- Thagavel, P., Pathak, P., & Chandra, B. (2019) Consumer Decision-making Style of Gen Z: A Generational Cohort Analysis. Global Business Review.

- Adrian, K., &Sahrani, R. (2021) Relationship Between Fear of Missing Out (FoMO) and Problematic Smartphone Use (PSU) in Generation Z with Stress as a Moderator. Advances in Social Science, Education and Humanities Research, volume 570.

- Battista, I., Curmi, F., & Said, E. (2021) Examining FoMO Triggered by Retargeted Advertisements on Young People. Proceedings of the Fourth Economics, Business and Organisation Research.

- Herawati, I., Rizal, I., &Amita, N. (2022) The Impact of Social Media on Fear Of Missing Out among Generation Z: A Systematic Literature Review, Journal of Islamic and Contemporary Psychology (JICOP).

- Cinar, D. (2021). An Overview of Fear of Missing Out Strategies Implemented by Brands. Current Marketing Studies and Digital Developments.

- Hodkinson, C. (2016). Fear of Missing Out’ (FOMO) marketing appeals: A conceptual model. Journal of Marketing Communications.

- Pusenius, A. (2023) Effects of FOMO Marketing Appeals on the Likelihood of Impulse Buying.

- Przybylski, A. K., Murayama, K., Dehaan, C. R., &Gladwell, V. (2013). Motivational, emotional, and behavioural correlates of fear of missing out. Computers in Human Behavior.

- Wolniewicz, C. A., Tiamiyu, M. F., Weeks, J. W., &Elhai, J. D. (2018). Problematic smartphone use and relations with negative affect, fear of missing out, and fear of negative and positive evaluation. Psychiatry Research.

- Sierra, J. J., & Hyman, M. R. (2011). Outlet mall shoppers’ intentions to purchase apparel: A dual-process perspective. Journal of Retailing and Consumer Services.

- Parrott, W. G., & Smith, R. H. (1993). Distinguishing the experiences of envy and jealousy. Journal of Personality and Social Psychology.

- Festinger, L. (1957). A theory of cognitive dissonance. Stanford, CA: Stanford University Press.

- Jain, V., Vatsa, R., &Jagani, K. (2014). Exploring Generation Z’s purchase behavior towards luxury apparel: A conceptual framework. Romanian Journal of Marketing.

- Swain, D., &Sahu, S. (2007). Branding for 21st Century Teenagers. International Marketing Conference on Marketing & Society.

- Rautela, S., & Sharma, S. (2022). Fear of missing out (FOMO) to the joy of missing out (JOMO): Shifting dunes of problematic usage of the internet among social media users. Journal of Information, Communication and Ethics in Society.

- Deci, E., & Ryan, E. (2015). Self Determination Theory. International Encyclopedia of social and behavioural sciences.

- Dogan, V. (2019). Why do people experience the fear of missing out (FoMO)? Exposing the link between the self and the FoMO through self-construal. Journal of Cross-Cultural Psychology.

- Kang, I., Cui, H., & Son, J. (2019). Conformity consumption behavior and FoMO.

- Argan, M., Aydinoglu,N., &Ozer, A. (2022). The delicate balance of social influences on consumption: A comprehensive model of consumer-centric fear of missing out. Personality & Individual Differences.

- Bump, P. (2019). Millennials vs. Gen Z: Why Marketers Need to Know the Difference… Retrieved from https://blog.hubspot.com/marketing/millennials-vs-gen-z

[1]Associate Professor, Dept. of Advertising & PR, Indian Institute of Mass Communication, India, E-mail- ujjainmeeta@gmail.com

[2]Research Schollar, Indian Institute of Mass Communication, India